Retirement Can Still Happen in 5 Easy Steps Bonus Perfect 401(k) Pack

"From Our Retirement Can Still Happen Series"

Watch Promo

Confused about how to build the perfect 401(k) plan?

Then look to this "Do It Yourself" (DIY) course to give you five worry-free steps. In our "Retirement Can Still Happen in 5 Easy Steps "Bonus Perfect 401(k) pack" we'll take you from being a workplace novice (only having a hammer to build your plan) to the workplace go-to carpenter (having a full selection of tools) using fundamental strategies I have implemented in my financial planning practice for more then 20 years.

Your 5 Easy "DIY" Steps Include:

INVENTORY: Overview of your blue prints.

OBJECTIVE: Envisioning your finished plan.

MIX: Laying the cement foundation with stocks, bonds, and mutual funds.

DIVERSIFICATION: Learn when it may be necessary to add additional space.

ADVANCE TIPS: Tips from live Workshop or Webinar ($2500 Value)

Why 5- Easy Steps To Building The Perfect 401(k)?

I could share many reasons why this course is essential, like statics, or how social security is set to run out of money, but I will spare you the details because there is work to do. I have decided to share my personal story with you instead. My first 401(k) experience in the workplace was not a good one. I was frustrated because none of my co-workers knew what to do, and the plan administrators were not advisors, so they could not assist either. The experience was unpleasant, as I lost nearly all of my money. What I had left I pulled out and spent the money on a new car and stereo CD player. I never put another dime in my plan. Not only did I pull my money out, but the retirement fund went on to be historically one of the best-performing funds ever. That was over 20 years ago, and it was a personal mission behind my journey to becoming a Financial Advisor. I desired to create an affordable platform for the DIY'ers who want to build their plans.

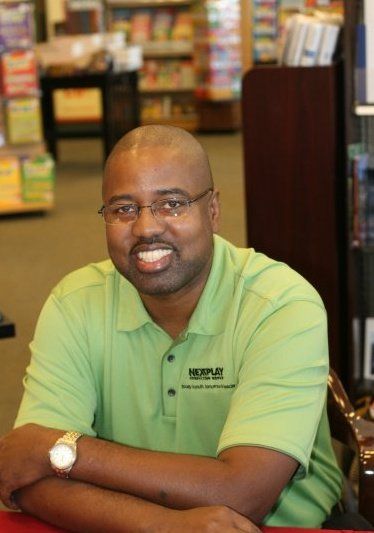

Your Instructor

It was more than 15 years ago when Jenny Jones, author of "5 Retirement Mistakes I Avoided" created the The Jones Educational Group as a way to share his passion of teaching. His passion for helping people in their finances created a fire in his heart to create My Retirement Exit, with additional help from his team. He found that some people were self starters so he launched this learning platform The My Retirement Exit Learning Network for "Do It Yourself" retirees. His signature instructional method, MtE (Motivation through Education) brought inspiration and possibility into the financial lives of hundreds of everyday people, from ages 7 to 70. Jenny has taught over 200 classroom hours of instruction for teens youth and adults. He has now brought that same energy over and created The My Retirement Exit Learning Network

Mr. Jones holds a Master’s Degree in Financial Management and

Accounting and a Bachelor’s

Degree in Business Marketing. He is a Graduate School Professor for Finance and he is a registered Financial Advisor for

The Jones Stewardship Group LLC.